ASB's FY2024 distribution at RM10.1b or 5.75 sen per unit, highest ...

KUALA LUMPUR (Dec 24): Amanah Saham Nasional Bhd (ASNB), a wholly owned unit trust company of Permodalan Nasional Bhd (PNB), has declared a total income distribution of 5.75 sen per unit, amounting to a total income payout of RM10.1 billion for Amanah Saham Bumiputera (ASB) for the financial year ending Dec 31, 2024 (FY2024).

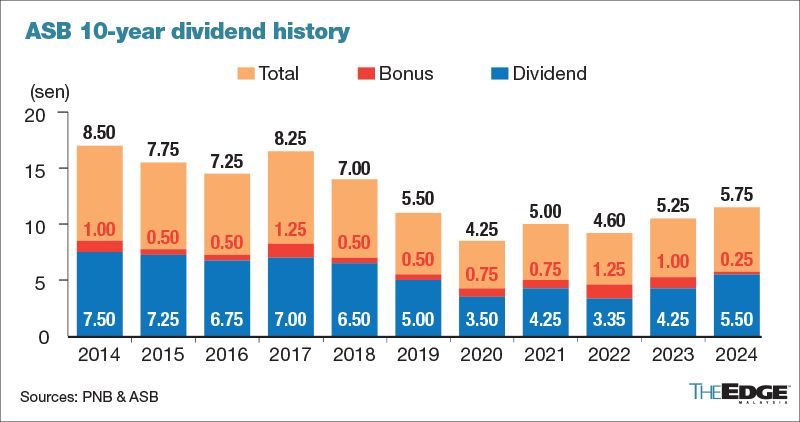

Payout for the fixed-price unit trust fund comprises an income distribution of 5.5 sen per unit, plus a bonus of 0.25 sen per unit, benefitting 11.1 million unit holders, PNB said in a statement on Tuesday.

The payout is ASNB's highest since FY2018, when it paid 6.5 sen dividend and 0.5 sen bonus. Compared to FY2023, ASNB paid 5.25 sen per unit (income distribution: 4.25 sen per unit, bonus: one sen per unit), with a total income payout of RM9.3 billion. ASNB, meanwhile, has distributed a total dividend of RM196.5 billion since inception.

“We are pleased that ASNB has been able to deliver its strongest dividend distribution over the last five years. This continues the strong track record of outperformance of ASNB’s fixed price funds over their reference portfolio in line with PNB’s purpose to uplift the financial lives of Malaysians across generations,” said PNB group chairman Raja Tan Sri Arshad Raja Tun Uda.

The computation of the income distribution and bonus for ASB is based on the average minimum monthly balance held throughout the fund’s financial year.

The units re-invested from the income distribution will be credited into the unitholders’ accounts on Jan 1, 2025.

AUM rebounds to RM347b after 2023 dipASNB has continued to deliver sustainable and above-market returns by outperforming the benchmark of Maybank 12-month fixed deposit rate, noted PNB. ASNB’s number of accounts increased by 2.4% to 11.1 million accounts, indicating continued confidence in ASNB as an essential savings and investment platform for Bumiputeras.

“ASNB’s improved performance was driven by the positive impact of PNB’s asset diversification strategy and the strong Malaysian public equity market, which benefited from robust Malaysian economic growth and the strengthening of the ringgit,” PNB said.

As of the end of November 2024, based on rolling one-year total returns, all ASNB variable price funds outperformed their respective benchmarks and were placed in the top two quartiles among their peers in their respective segments.

For example, the six ASNB equity funds had recorded a rolling one-year total return of between 15% and 33% up to Nov 30 this year, with its oldest fund Amanah Saham Nasional (ASN) and ASN Equity Malaysia recording a rolling one-year return of 23.4% and 33.2%, respectively.

PNB’s asset under management (AUM) grew to RM347 billion in 2024, from RM337 billion last year. The total number of accounts increased 3.2% to 16.2 million, with ASNB adding more than 400,000 new unique holders, being the preferred investment of choice of more than 13 million Malaysians.

“PNB is committed to growing the savings of Malaysians by encouraging the public to save more and growing these savings by delivering sustainable, market leading returns,” PNB president and group chief executive Datuk Abdul Rahman Ahmad said.

PNB planned to elevate its efforts on financial literacy by providing educational programmes and resources to empower Malaysians with the knowledge to make informed financial decisions.

“We will also intensify our marketing initiatives to underscore the importance of cultivating a consistent savings habit for unitholders’ long-term financial security,” he said.